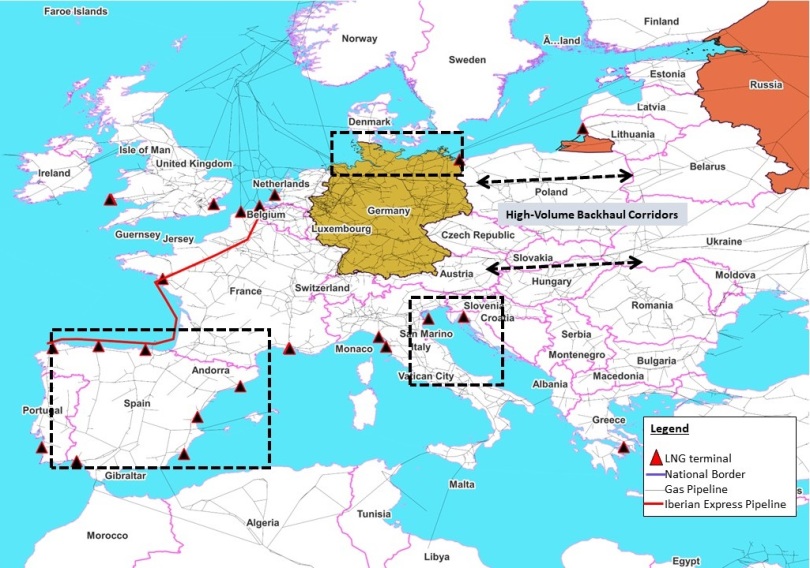

The Nord Stream explosions emphasize that Europe faces a multi-year gas and energy crisis. An “Iberian Express” gas pipeline would help permanently offset lost Russian supplies by linking Spanish (and perhaps also Portuguese) LNG terminals to gas-starved Germany and Central Europe. Pipeline expansions/newbuilds could be rapidly executed–perhaps in less than a year–but require French consent, which Paris has thus far withheld.

Spain and Portugal offer long coastlines exposed to the open Atlantic, are relatively distant from Russian naval power (unlike the Baltic and Black Seas), and have installed LNG terminal capacity far exceeding local demand. They also lack high-volume trunk gas pipelines connecting them to the rest of Europe. Data from CEDIGAZ covering most of the past decade suggest that collectively, LNG terminals in Southern Europe (primarily Portugal and Spain) could take in 30-40 billion cubic meters (BCM) more gas than they actually handle each year. Adding the previously mothballed El Musel facility along the Bay of Biscay coast would add another 8 BCM/year to the total.[i]

Gas Wants to Come in But is Bottlenecked Due to Insufficient Pipeline Connectivity to Rest of Europe

Source: Reuters

As we pointed out in 2018, the Iberian corridor offers low-hanging fruit for increasing secure gas supplies to Europe. Unlike in 2018, Europe now faces a gas security challenge under conditions of wartime intensity. The EU—perhaps with US support—should thus urgently fund an “Iberian Express Pipeline” to link the Iberian Peninsula’s gas import facilities more tightly with the remainder of Europe. Two complementary possibilities exist.

The first would entail completing the MidCat pipeline between Catalonia and southern France, which could add 7.5 BCM/yr of cross-border capacity (for a total of approximately 15 BCM). Notably, the powerful Foment de Treball business lobby voiced enthusiastic support for MidCat in the wake of Russia’s invasion of Ukraine, with its president saying that “Spain can be a ‘gas hub’ of Europe.”[ii] Multiple left-leaning Spanish political constituencies, including the Socialist Workers’ Party, People’s Party, and the Citizens Party express support for the pipeline, but appear to take the view that it should be used to move green hydrogen.[iii] Green hydrogen is not currently produced at industrial scale in the pipeline’s catchment area and questions thus remain about the degree of political support in Spain for finishing MidCat and using it for natural gas. Russia’s actions have put the project back into play but its potential within the next 2-3 years remains unclear and is amplified by the need to improve pipeline infrastructure on the MidCat corridor’s French side.

Exigency created by Russia’s gas embargo thus suggests other routes—even if longer and more expensive—should also be pursued. One of the more sensible potential routes would run offshore along Spain’s northern coast with spur lines from each LNG terminal, make landfall along Brittany’s Bay of Biscay coast and run onwards to the Zeebrugge, Belgium area. The route would be approximately 1,600km long and would create a market linkage between Iberian import facilities and the well-connected hub zone of Northwest Europe. Spare Iberian gas could displace imports of North Sea supplies and render them available for buyers in Germany (a virtual expansion via molecule displacement through existing infrastructure). Gas from northern Spain into NW Europe could, through displacement, also potentially permit expansion of supplies through the Baltic Pipe corridor into Poland and other areas deep in eastern Europe.

Such pipelines normally entail a formidable planning and construction timetable. For instance, the subsea 1,224 kilometer (km) Nord Stream-1 project required approximately six years to plan, build, and bring into full service.[iv] But there is a precedent for building major pipelines faster under wartime conditions. During World War II, submarine attacks badly disrupted tanker shipments of oil from Texas to the Northeast. In response, a public-private partnership constructed the two pipelines of approximately 2,000 km in length each—the “Big Inch” that carried crude oil and the “Little Big Inch” that carried refined products. Each line was planned and constructed in less than two years.

While the “Big Inch” projects were built nearly 80 years ago, the historical analogy remains relevant to the contemporary gas security challenge Europe now faces. American Secretary of the Interior Harold Ickes remarked in 1940 that “building of a crude pipeline from Texas to the East might not be economically sound, but in the event of an emergency it might be absolutely necessary.”[v] Then the Nazi war machine rapidly turned the option into a strategic necessity for America’s oil industry in the early 1940s, just as Russian revanchist actions in 2022 now do for European gas consumers.

While we do not yet know the full extent of long-term benefits an Iberian Express project might bring, the “Big Inch” experience suggests at least two. To start, it helped the Allies win the war. As historian Keith Miller put it, “Without the prodigious delivery of oil from the US, this global war, quite frankly, could never have been won.”[vi] While the energy pathways to victory are somewhat different today, the broad concept of energy abundance underpinning successful containment and defeat of a foe still holds fast today. In addition, the pipeline corridors established eight decades ago through decisive, rapid action by a public-private partnership remain in service today to the benefit of American consumers and industry. European officials should draw inspiration from the “Big Inch” initiative’s success.

Additional reading

–Collins, Gabriel, Anna Mikulska, and Steven Miles. 2022. Winning the Long War in Ukraine Requires Gas Geoeconomics. Research paper no. 08.25.22. Rice University’s Baker Institute for Public Policy, Houston, Texas.

–Gabriel Collins, Anna Mikulska, and Steven Miles, “Gas Geoeconomics Essential to Win

the ‘Long War’ In Ukraine—And Asia,” Baker Institute Research Presentation, September 2022

[i] “El Musel LNG Terminal,” Global Energy Monitor Wiki, https://www.gem.wiki/El_Musel_LNG_Terminal.

[ii] “Foment proposes reviving the Midcat and making Spain a gas hub of southern Europe,” (Foment propone resucitar el Midcat y que España sea ‘hub’ gasístico del sur de Europa), El Confidencial, 1 March 2022, https://www.elconfidencial.com/economia/2022-02-28/la-patronal-catalana-propone-que-espana-se-convierta-en-hub-gasistico-del-sur-de-europa_3383706/

[iii] “The Socialist Workers’ Party, People’s Party, and Citizens’ Party agree to promote the Midcat gas pipeline to France and use it to transport green hydrogen,” (PSOE, PP y Cs pactan impulsar el gasoducto Midcat con Francia y usarlo para hidrógeno verde), EPE, 11 May 2022, https://www.epe.es/es/economia/20220511/psoe-pp-cs-impulsar-midcat-francia-hidrogeno-verde-13644202

[iv] “Nord Stream by the Numbers,” Nord Stream AG, https://www.nord-stream.com/the-project/construction/.

[v] Keith Martin, “The Big Inch: Fueling America’s WWII War Effort,” National Institute of Standards and Technology, March 26, 2018, https://www.nist.gov/blogs/taking-measure/big-inch-fueling-americas-wwii-war-effort.

[vi] Martin, “The Big Inch: Fueling America’s WWII War Effort.”